Benefits and Offers

- Transfer Entire Credit Limit to your Account

- No Plastic Card, No reward points

- Zero Annual Fee

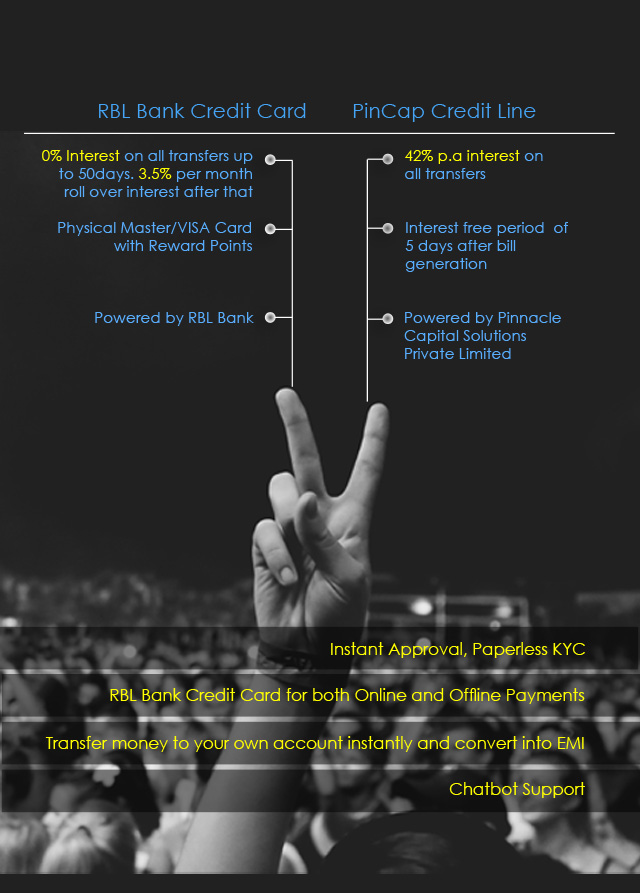

- Finance Charges are 42% p.a

- Finance Charges reduce based on credit score and spend history

- Personalized offers on Food, Shopping, Entertainment, Online Spend etc.

Get started

- Complete Application on App or Web

- Basic Demographics, PAN details

- On Approval, Complete Application with Aadhaar based KYC

- If Current Address doesn’t match Aadhaar – edit Aadhaar details to match current address on the UIDAI website

Using vCard

- Move entire limit to your account and convert into EMIs

- Tag spends to different categories, set budgetary limits

- Leverage analytics and reminders for insight to manage expenditure

Repayment

- On or before due date, make payment through UPI/ Netbanking on the vCard app

- If unable to make full payment, pay at least the Minimum Amount Due to avoid late fees

- If you make any payment before the due date, it reduces the overall Finance Charges

Credit Line Charges

- Zero Annual Fees

- Late fees 3% of Total Due Max of Rs 925

- Convenience Fees per month :Rs 0 if Total Due < 200, Rs 20 if Total Due between Rs 200 - 6000, Rs 100 if Total Due >= 6000

vCard Credit line Contact details

- GRIEVANCE REDRESSAL - In case of any grievance please find the details:

- Grievance Redressal Officer

Shivank Paliwal - Contact Numbers:

+91 8130195773 - Email Id:

support@pincap.in - Registered Address

Pinnacle Capital Solutions Pvt Ltd

C/43, B Block, Pardesi Pora Sonari, East Singbhum Jamshedpur Purba Singhum JH 831011 IN - For any further complaint/issue, you may Contact us.

- vCard Credit Line

- vCard Customer Care mail id: hi@vcard.ai

Frequently Asked Questions

- Who is eligible to apply for vCard

Anyone who is Salaried /Self Employed holding an Aadhaar card + PAN card and of age group 23 years to 55 years is eligible to apply - What are the documents required to apply for vCard

Selfie based photo taken online and Aadhar card as ID/Address proof .It is essential that current address is same as mentioned on Aadhar - What is the Process to apply for vCard

You may initially check eligibility through https://app.vcard.ai/vmod/checkEligibility post eligibility approval you need to fill up the KYC details and then upload Aadhar as document -Once the application is approved you may start using the vCard instantly. - What is the fee and the interest charges structure? Are there any hidden fee?

You will be charged a Finance Charge of 42% p.a (Rs. 1.15 per 1000 or 0.115% per day) and the amount payable is calculated accordingly monthly. The late fee shall not be collected for 5 days after bill generation however Rs.100 as Convenience charges will be levied if total due >= Rs.6000, Rs 20 if Total Due is between Rs 200-6000.

- Minimum amount of 5% is payable, failing which the account goes Delinquent and also attracts late fees of 3% of Total Due Subjected to Max Rs 925 - What is the Maximum Credit Limit I can get

The maximum eligible amount is Rs.60,000 - When will I receive my statement

Bill will be generated on the last day of every month - Is there any Annual fee charges for vCard

There is no annual fee charged - Is there any Possibility to enhance the Limit after certain period of usage

There is no possibility to enhance the amount at this point of time however will be accordingly communicated if the same is considered - What are the various charges applicable on the Credit line

Other than Late fee and Interest, Convenience charge of Rs.100 will be levied if total due >= Rs.6000, Rs 20 if Total Due is between Rs 200-6000 will be charged on every month bill - How can I generate my m-PIN

m-PIN can be generated after signing up in to vCard app with your registered mobile number - How can I change /update my m-PIN

m-PIN can be changed at any time through vCard app, from Settings option in menu bar - What is the option for bill Payment

Bill will be generated on the last day of every month and the same can be paid through Net Banking / eMandate - How is the interest calculated on my account

You will be charged Finance Charges of 42% p.a (Rs. 1.15 per 1000 or 0.115% per day) and the amount payable is calculated accordingly and charged monthly. - Where all can I use vCard ?

* Transfer amount to self savings bank account instantly - How my Credit Line dues are informed to me

You will be sent a billing statement detailing the transactions on vCard app well before the due date for payment of dues.

Billing information is also made available by email if you have registered with your email id.

You will also be informed by an SMS Alert about the billing amount and due date for payment of dues.